- Senior Management

- Chairman's Statement

- Management Discussion and Analysis

Executive Director

Executive Director

Mr. JING Shiqing, aged 44, has been appointed as the Chairman of the Board of the Company since January 2025 and an executive Director since April 2023. He is the Chairman of the Strategy and Investment Committee, the Chairman of the Nomination Committee, an authorised representative and the director of certain subsidiaries of the Company. Mr. JING joined China Resources Group in July 2003 and had served as the Deputy General Manager of the Human Resources Department of China Resources Group from May 2018 to March 2021, a non-executive director of the Company from May 2018 to May 2021 and a non-executive director of China Resources Gas Group Limited (the shares of which are listed on the main board of the Stock Exchange, stock code: 1193) from August 2018 to May 2021 respectively. He joined the Company in May 2021 and had served as the Vice President of the Company from May 2021 to April 2023 and the Chief Executive Officer from April 2023 to January 2025, previously responsible for the management of the Marketing Management Department, the Smart & Information Technology Department and the Technology and Innovation Department of the Company and the operational development of certain regions. Mr. JING holds a bachelor’s degree in engineering from the Changsha University of Science and Technology, China and a master’s degree in business administration from the Nanjing University, China. He has over 15 years of experience in corporate management, and is currently the Vice President of the Fifth Council of the Guangdong Building Materials Association.

Executive Director

Executive Director

Mr. XIE Ji, aged 52, has been appointed as the Chief Executive Officer of the Company and an executive Director since January 2025. He is a member of the Strategy and Investment Committee of the Company. Mr. XIE joined China Resources Group in 1993, was a Deputy General Manager of the Strategic Management Department of China Resources (Holdings) Company Limited from August 2024 to January 2025, worked in China Resources Land Limited (the shares of which are listed on the main board of the Stock Exchange, stock code: 1109) from October 2001 to August 2024 and served as a Vice President from July 2010 to June 2013, a Senior Vice President from June 2013 to August 2024, an executive Director from April 2017 to August 2024 and the Chief Strategy Officer from January 2021 to August 2024, responsible for strategy and investment of China Resources Land Limited. He had previously worked for China Resources Construction Co., Limited. Mr. XIE holds a bachelor’s degree in Civil Engineering from Tongji University, China and an executive master’s degree in business administration from China Europe International Business School, China. He has over 20 years of experience in property management and corporate management.

Mr. LI Baojun, aged 56, has been appointed the Vice President of the Company since December 2020, responsible for the management of the Functional Building Materials Business Division and the South China Region of the Company. Mr. LI joined China Resources Group in September 2002 and had served as the General Manager of the Strategic Management Department of China Resources Power Holdings Company Limited as well as the Assistant General Manager of the Strategic Management Department of China Resources Group. He joined the Group in January 2014 and had served as the Chief Strategy Officer, the General Manager of the International Department and the Regional General Manager (Hainan) of the Company. Mr. LI obtained a bachelor's degree in engineering from the Tianjin University, China in 1990, a master's degree in industrial engineering from the Hebei University of Technology, China in 2003 and a master's degree in business administration from the China Europe International Business School, China in 2012. He has approximately 20 years of experience in strategic development and corporate management

Mr. Liu Wei, aged 48, has been appointed the Vice President of the company since May 2025. Mr. Liu joined the group in November 2007 and has held several positions, including Deputy Director and Director of Strategic Management at China Resources (Group) Co., Ltd., Director, General Manager, and Southwest Regional General Manager of China Resources Power Holdings Company Limited, as well as Minister of the Mass Work Department and a senior management position at the vice president level at China Resources Microelectronics Limited. Mr. Liu holds a Bachelor's degree in Engineering from Southwest Jiaotong University and a Master’s degree in Business Administration from South China University of Technology.

Mr. CHEN Anguo, aged 47, has been appointed as the Vice President of our company since July 2023, responsible for the management of environmental health and safety, the Southeast region, and Fujian Cement. He joined CR Gas in September 2005 and has held various positions including General Manager of Zhongshan Regional Company, Deputy General Manager of Southwest Region, and Deputy General Manager of Huaxi Region. He holds a bachelor's degree from Nanjing University of Chemical Technology and a master's degree in engineering from Nanjing University of Technology. With over 20 years of management experience, Mr. Chen possesses extensive expertise in corporate management.

Mr. CHANG Yang, aged 42, has been appointed as a Vice President-level senior management personnel of our company since July 2023, responsible for the management of discipline inspection and inspection work. Mr. Chang joined CR Gas in August 2010 and has held various positions including Senior Manager and Professional Director of the Discipline Inspection and Supervision Office of CR Group, Vice President and General Manager of CR Vanguard Living, and General Manager of the Discipline Inspection Department. He holds a master's degree in history from Renmin University of China. With over ten years of management experience, Mr. Chang possesses extensive expertise in corporate management.

Madam HUANG Hu, aged 45, has been appointed as the Chief Financial Officer of Company since July 2024 and the Board Secretary (Acting) since December 2024. She joined China Resources Group in September 2009 and had served as the General Manager of the Finance Department of China Resources Ng Fung Limited, the Assistant General Manager and the Deputy General Manager of China Resources Beverage (Holdings) Company Limited). Madam HUANG obtained a bachelor’s degree in management studies from the Hunan University, China, in 2001. She has over 15 years of experience in financial management.

Mr. Pan Fei, aged 40, has been appointed the Vice President of the company since October 2024, responsible for the management of the Structural Materials Division and the Hong Kong Regional Division. Mr. Pan joined the group in October 2008 and has held several management positions, including Deputy General Manager and General Manager of the Structural Materials Division. He obtained his Bachelor's degree in Management from Xuzhou Normal University in June 2007. He has over 15 years of extensive experience in marketing and corporate management.

FINAL RESULTS

The consolidated turnover for the year ended 31 December 2024 amounted to RMB23,037.8 million, representing a decrease of 9.8% over that of last year. The consolidated profit attributable to owners of the Company for the year ended 31 December 2024 amounted to RMB210.9 million, representing a decrease of 67.2% over that of last year. Basic earnings per share for the year was RMB 0.030.

DIVIDENDS

On Friday, 16 August 2024, the Board declared an interim dividend of HK$0.02 per Share in cash for 2024 (2023: HK$0.041 per Share) which was paid on Friday, 25 October 2024. On Friday, 14 March 2025, the Board resolved to recommend the payment of final dividend of HK$0.01 per Share in cash for the year ended 31 December 2024 (2023: HK$0.006 per Share). Subject to approval by shareholders of the Company at the forthcoming annual general meeting, the final dividend will be distributed on or about Wednesday, 23 July 2025 to shareholders of the Company whose names appear on the register of members of the Company on Friday, 13 June 2025. The total distribution for the year ended 31 December 2024 will be HK$0.03 per Share (2023: HK$0.047 per Share).

The final dividend will be payable in cash to each shareholder in HK$ by default. Shareholders may also elect to receive the final dividend in RMB. Procedures for electing to receive the final dividend in RMB are set out in the dividend section of the Report of the Directors.

BUSINESS ENVIRONMENT

In 2024, in the face of a complex and severe situation arising from increasing external pressures and accumulating internal difficulties, the Chinese government adhered to the general principle of pursuing progress while maintaining stability, completely, accurately and thoroughly implemented the new development philosophy, accelerated the construction of a new development paradigm, solidly promoted high-quality development, and steadily developed new productivity, which had resulted in the overall stable operation of the national economy with progress in stability, new advancements made in high-quality development, and especially the prompt introduction and deployment of a series of incremental policies to effectively boost social confidence and significant economic recovery, which had successfully accomplished the main goals and tasks for economic and social development. In 2024, the GDP of China grew by 5.0% year-on-year to RMB134.9 trillion, and national FAI (excluding rural households) increased by 3.2% year-on-year to RMB51.4 trillion.

According to the statistics published by the respective provincial bureaux of statistics, in 2024, the GDPs of Guangdong, Guangxi, Fujian, Hainan, Yunnan, Guizhou, Shanxi, Hunan, Hubei, Shandong, Chongqing and Shaanxi, where the Group has business operations, reached RMB14.2 trillion, RMB2.9 trillion, RMB5.8 trillion, RMB793.6 billion, RMB3.2 trillion, RMB2.3 trillion, RMB2.5 trillion, RMB5.3 trillion, RMB6.0 trillion, RMB9.9 trillion, RMB3.2 trillion and RMB3.6 trillion respectively, representing year-on-year increases of approximately 3.5%, 4.2%, 5.5%, 3.7%, 3.3%, 5.3%, 2.3%, 4.8%, 5.8%, 5.7%, 5.7% and 5.3% respectively. In 2024, the year-on-year changes in FAI of the aforementioned provinces were approximately -4.5%, -3.2%, 3.9%, 7.1%, -7.7%, 0.6%, 3.2%, 2.8%, 6.5%, 3.3%, 0.1% and 5.2% respectively

In terms of stabilizing investment, in 2024, approximately RMB4.7 trillion of new local government bonds were issued nationwide, among which, approximately RMB4.0 trillion were new special bonds. The Central Politburo meeting deployed a package of incremental policies to enhance counter-cyclical adjustments in fiscal and monetary policies, adequately issue and utilize ultra long-term special government bonds and local government special bonds and more effectively utilize the driving role of government investment. According to the statistics published by the National Bureau of Statistics of China, in 2024, the national infrastructure investments (excluding the industries for production and supply of electricity, heat, gas and water) increased by 4.4% year-on-year. According to the statistics published by the Ministry of Transport of China and the National Railway Administration of China, from January to November 2024, FAI on highways and waterways in China amounted to approximately RMB2.6 trillion, representing a decrease of 9.6% year-on-year. In 2024, FAI on railways amounted to approximately RMB850.6 billion, representing an increase of 11.3% year-on-year, which surpassed the RMB800 billion milestone for the first time in five years and set a new historical high for investment.

In 2024, the Chinese government initiated the stabilization and recovery of the real estate market, lowered housing loan interest rates and down payment ratios, solidly promoted the work of ensuring timely delivery of housing, and explored the construction of new model for real estate development. According to the statistics published by the National Bureau of Statistics of China, in 2024, the floor space of new commodity housing sold in China decreased by 12.9% year-on-year to 970 million m2 and the sales amount decreased by 17.1% year-on-year to RMB9.7 trillion. Real estate development investment in China decreased by 10.6% year on-year to RMB10.0 trillion. Among which, the floor space of houses newly started construction decreased by 23.0% year-on-year to 740 million m2 while the floor space of houses completed decreased by 27.7% to 740 million m2. As of the end of December 2024, the floor space under construction by the real estate developers nationwide decreased by 12.7% year-on-year to 7,330 million m2.

In 2024, the Chinese government proposed the intensive implementation of urban renewal actions and strengthened urban infrastructure construction to promote the key tasks of renovation of old urban communities, acceleration of construction of affordable housing, construction of public infrastructure for “dual uses in normal and emergency situations”, and renovation of urban villages. According to the statistics published by the Ministry of Housing and Urban-Rural Development of China, in 2024, 58,000 old communities nationwide newly started renovations, which had surpassed the annual target of 54,000.

THE INDUSTRY

According to the statistics published by the National Bureau of Statistics of China, in 2024, the total cement production in China amounted to approximately 1,830.0 million tons, representing a year-on-year decrease of 9.5%. During the year, cement production in Guangdong, Guangxi, Fujian, Hainan, Yunnan, Guizhou, Shanxi and Hunan were approximately 131.0 million tons, 94.9 million tons, 64.0 million tons, 14.6 million tons, 88.6 million tons, 52.7 million tons, 41.4 million tons and 72.5 million tons respectively, representing year-on-year changes of approximately -8.5%, -5.2%, -9.0%, -5.7%, -7.4%, -10.5%, -11.2% and -11.9% respectively.

During the year, according to the statistics of the China Cement Association, there were 7 new clinker production lines nationwide with new annual clinker production capacity of approximately 10.4 million tons. Among which, in the major operating regions of the Group, there were 1 new clinker production line in Guangdong with new annual clinker production capacity of approximately 1.4 million tons, 1 new clinker production line in Fujian with new annual clinker production capacity of approximately 1.6 million tons, 1 new clinker production line in Guizhou with new annual clinker production capacity of approximately 1.9 million tons and 1 new clinker production line in Hunan with new annual clinker capacity of approximately 1.5 million tons.

Regarding policies for the industry, the Chinese government had introduced a series of policies and measures to accelerate the promotion of green, low-carbon transformation and high quality development of the industry, improve utilization efficiency for energy and resources, refine and strictly enforce capacity replacement policies, promote regular off-peak production and advance rationalization of industrial structure to lay the foundation for achieving the goals of “carbon peaking” and “carbon neutrality”. In addition, the Chinese government attaches great importance to production safety and occupational health, and fosters the high-quality and sustainable development of the building materials industry.

Regarding energy saving and emissions reduction, the Chinese government actively implemented energy saving and low carbon actions, advanced ultra-low emissions upgrades in the cement industry and strengthened the management of carbon emissions intensity to support the green, low-carbon and high quality development of the industry. In January 2024, the Ministry of Ecology and Environment of China, together with the National Development and Reform Commission of China, the Ministry of Industry and Information Technology of China, the Ministry of Finance of China and the Ministry of Transport of China, jointly issued the “Opinions on Promoting the Implementation of Ultra-Low Emissions in the Cement Industry” to promote the implementation of ultra-low emission upgrades for cement and clinker production enterprises (excluding mines) and independent grinding stations. It is targeted that by the end of 2025, significant progress will be achieved in key regions, striving for completing the upgrades for 50% of cement and clinker production capacity with large state-owned enterprise groups in such regions to have basically completed organized and unorganized ultra-low emission upgrades. By the end of 2028, cement and clinker production enterprises in key regions are aimed for basic completion of upgrades, striving for completing upgrades for 80% of cement and clinker production capacity nationwide. In March 2024, the National Development and Reform Commission of China and the Ministry of Housing and Urban-Rural Development of China jointly issued the “Work Plan for Accelerating Energy Saving and Carbon Reduction in the Construction Sector”, which specified that by 2025, the regulatory framework for energy saving and carbon reduction in the construction sector will be further improved and all new buildings in cities and towns will fully implement green building standards. The construction sector is a major consumer of energy consumption and a major emitter of carbon dioxide with energy consumption and carbon dioxide emissions maintaining rigid growth, presenting huge potential for energy saving and carbon reduction. In May 2024, the National Development and Reform Commission of China, the Ministry of Industry and Information Technology of China, the Ministry of Ecology and Environment of China, the State Administration for Market Regulation of China and the National Energy Administration of China jointly issued the notice for the “Special Action Plan for Energy Saving and Carbon Reduction in the Cement Industry”, which aimed at, by the end of 2025, control of cement and clinker production capacity at approximately 1.8 billion tons, with the proportion of production capacity above the energy efficiency benchmark level to have reached 30%, completion of either technological upgrade or phasing out and exit of production capacity below the energy efficiency benchmark level and the decrease of comprehensive energy consumption per unit product of cement and clinker by 3.7% compared to 2020.

In terms of green development, China adhered to the principle that “green waters and green mountains are gold mountains and silver mountains”, unswervingly followed the path of eco-centric and green development, and promoted the comprehensive green transformation of economic and social development. In February 2024, the Ministry of Industry and Information Technology of China, together with the National Development and Reform Commission and seven other departments including the Ministry of Finance of China, issued the “Guiding Opinions on Accelerating the Green Development of the Manufacturing Industry”, which proposed that by 2030, the output value of green factories shall account for more than 40% of the total output value of the manufacturing industry, and green development will become a solid foundation for promoting new industrialization. In addition, the opinions proposed to promote the six aspects of high-end transformation of industrial structure, low-carbon transformation of energy consumption, circular transformation of resources utilization, clean transformation of production processes, green transformation of product supply and digital transformation of manufacturing processes in order to strengthen green manufacturing, develop green service industries, expand green energy industries and develop green low-carbon industries and supply chains.

In terms of energy consumption, in May 2024, the State Council of China issued the “2024–2025 Action Plan for Energy Saving and Carbon Reduction”. The plan enhanced the regulation and control of the total amount and intensity of energy consumption, focused on controlling fossil energy consumption, strengthened the management of carbon emissions intensity, and implemented sector-specific and industry-specific special actions for energy saving and carbon reduction, aiming to work on energy saving and carbon reduction at a higher level and of a higher quality and better unleash the economic, social and ecological benefits of energy saving and carbon reduction to lay a solid foundation for achieving the goals of carbon peaking and carbon neutrality. At the same time, specific goals were proposed for reduction of energy consumption per unit of GDP, reduction of carbon dioxide emissions per unit of GDP, reduction of energy consumption per unit of value added by industrial entities above a designated scale, the proportion of non-fossil energy consumption and the amounts of energy saving and carbon reduction in key sectors and industries. Specifically for the building materials industry, the plan required stronger regulation and control of production capacity and output in the building materials industry, stricter control over the approval for entry of new building materials projects and the promotion of transformation for energy saving and carbon emissions reduction in the building materials industry.

In terms of the “dual carbon” efforts, the Chinese government had steadily and orderly promoted the construction of the national carbon emission trading market. In September 2024, the Ministry of Ecology and Environment of China issued the “Work Plan for the Inclusion of the Cement, Steel and Electrolytic Aluminum Industries in the National Carbon Emission Trading Market (Draft for Consultation and Comments)”, which specified 2024 as the first year of regulation for the cement, steel and electrolytic aluminum industries, with the initial work of contract fulfilment to be completed by the end of 2025. Taking into account that the key emission units newly included in the market will need some time to grasp the rules, become familiar with the market and improve their management capabilities, the plan proposed to promote market construction in two phases: 2024–2026 as the initial implementation phase and 2027 as the in-depth improvement phase to ensure the active, steady and orderly launch of expansion work.

In terms of industrial structure, policy institutions had continued to improve. In June 2024, in order to further consolidate the achievements of capacity reduction in the cement and glass industries, optimize the industrial layout, advance the dynamic balance between market supply and demand and promote the high-quality development of the cement and glass industries, the Ministry of Industry and Information Technology of China i ntroduced the “Implementation Measures for Capacity Replacement in the Cement and Glass Industries (2024 Edition) (Draft for Consultation of Comments)”. On the basis of the existing replacement ratio, the draft measures had added provisions for solid waste such as industrial waste and tailings slag, reflecting the government’s encouragement of the comprehensive utilization of cement kilns. Through the strict prohibition of cross-province capacity replacement, the exit of obsolete production capacity is accelerated and the development of new-type green cement products is encouraged. In October 2024, Ministry of Industry and Information Technology of China issued the “Implementation Measures for Capacity Replacement in the Cement and Glass Industries (2024 Edition)”, which eliminated the kiln diameter verification method, tightened requirements for cement capacity replacement, strengthened regional production capacity flow restrictions and prohibited cross-province replacement in key areas.

In terms of production safety, the Chinese government places strong emphasis on production safety. In January 2024, the National Mine Safety Administration of China issued the “Key Points for Mine Production Safety Works in 2024”, which proposed to deepen the overall investigation of latent disaster-causing factors, vigorously advance the pre-emptive management and treatment of major disasters, select and adequately equip mine safety management personnel of strong capability, standardize the management of outsourced mining teams, strengthen the intelligentization construction of mines, strictly tally accidents and submit information, seriously investigate and handle accidents in order to promote the transformation of mine safety management model towards pre-emptive prevention. In February 2024, the Work Safety Commission of the State Council of China issued the “Three Year Action Plan to Address the Root Causes of Work Safety (2024– 2026)”, which proposed a total of 20 specific measures in 8 aspects to encourage all units over a three-year period to continuously improve intrinsic safety levels, accelerate the promotion of modernization of governance systems and governance capabilities for production safety, and foster positive interactions between high-quality development and high-level safety.

TRANSFORMATION AND INNOVATION

In 2024, the Group actively seized development opportunities of new businesses, fully leveraged on the integrated synergistic advantages of cement, aggregates and concrete, and achieved rapid development in the aggregates business and initial success in the optimization of business structures.

In terms of basic building materials, the Group further consolidated its competitiveness in the South China market. In February 2024, the Group officially completed construction and commenced operation of Runsheng Quarry, with new annual production capacity of approximately 2.0 million tons of aggregates in Zhaoqing City, Guangdong. In March 2024, the Group officially completed construction and commenced operation of the concrete project with supporting aggregates production line, with new annual production capacity of approximately 2.0 million tons of aggregates in Pingnan County, Guigang City, Guangxi. In July 2024, the Group officially completed construction and commenced operation of the Dongye Mountain aggregates project, with new annual production capacity of approximately 5.0 million tons of aggregates in Qintang District, Guigang City, Guangxi. In October 2024, the Group officially completed construction and commenced operation of the Wuzi Mountain aggregates project, with new annual production capacity of approximately 2.0 million tons in Fuchuan County, Hezhou City, Guangxi. In the same month, the Group commenced trial production of the aggregates project, with new annual production capacity of approximately 3.0 million tons in Weishan County, Dali Bai Autonomous Prefecture, Yunnan. In December 2024, the Group commenced trial production of the Runyang aggregates project, with new annual production capacity of approximately 5.0 million tons in Chongyang County, Xianning City, Hubei.

In terms of structural building materials, the Group actively implemented the integrated development strategy of cement, aggregates and concrete, positioned concrete as the sales channel for cement and aggregates, reinforced business synergy through the establishment of 10 industrial parks, controlled production capacity and boosted sales through asset-light models in core markets such as the Guangdong-Hong Kong-Macao Greater Bay Area and Hainan, which had further consolidated the Group’s leadership position and influence in the terminal markets.

In terms of functional building materials, the Group had preliminarily completed its nationwide layout for the engineered stone business. Through continuous iteration and upgrade of more high-quality stone products, the Group had excelled in areas such as green manufacturing, green products, green supply chain management, social responsibility and technological creation in habitat construction, which had been recognized by the industry and customers

The Group plans its development from the lofty perspective of harmonious coexistence between human and nature, takes “ecology, environmental protection, safety, and intensive utilization of resources” as the central theme of work, actively engages in the businesses of energy saving, emission reduction, pollution reduction and carbon reduction, continuously promotes corporate industrial transformation and upgrade and persistently pursues the path of green and sustainable development. The Group steadily and orderly advances initiatives for carbon peaking and carbon neutrality, puts the concept of “green waters and green mountains are gold mountains and silver mountains” into practice, and is dedicated to becoming a role model of green and low-carbon development in the building materials industry.

In 2024, the Group added 7 new green mines of provincial level or AR level and completed construction of 9 green mines of national level and 23 green mines of provincial level or AR level.

In 2024, the Group actively promoted research and development of new products and new technologies, and promoted the application of raw material roller press and energy saving and carbon reduction technologies in cement grinding. At the same time, the Group keeps pace with the new era of dual carbon, led the promotion of green and innovative development, independently developed additives for raw materials and conducted trials at multiple production plants. In addition, the Group continuously advanced the construction of digital smart mines, actively promoted the application of all-electric mining trucks, unmanned driving, smart drilling and digitalization in mines to facilitate the construction of green mines

In 2024, the Group’s unfailing efforts in technological innovation and corporate social responsibility work were recognized by the industry and the society. These include:

• In February 2024, the “Complete Set of Technology and Application Demonstration of One-Stop Utilization of Waste Rocks from Mines and Construction Solid Waste for the Production of Low-Carbon Cement and Concrete” project of the Group’s cement production plant located in Changjiang, Hainan, was awarded the scientific and technological achievement appraisal certificate by the China Building Materials Federation. The project achievements were recognized as having reached an overall level of international advancement, among which, the “Key Technologies for Producing Low-Carbon Cement and Concrete by Utilization of High-Aluminum and Low-Calcium Waste Rocks” had reached the international leading level;

• In June 2024, owing to performance in fulfilling responsibilities in ESG aspects, the Company was selected into the list of “China Listed Companies ESG Pioneer 100” for the second consecutive year, with a rank of 13 on the list again and ESG performance at a “five-star” level;

• In October 2024, the two projects of “Research, Development and Engineering Application of Key Technologies for Multi Stage Cement Calcination + Coupling Reconstruction of Heat Exchange” and “Development and Application of Carbon Reducing Cement Grinding Aid Technology” of the Group successfully passed the science and technology accreditation of the China Building Materials Federation;

• In October 2024, the “Key Technologies in Engineering Projects for Treating Major Sudden Water Disasters in Underground Coastal Karst Areas” of the Group was awarded the first prize of the Science and Technology Progress Award of the Chinese Society for Rock Mechanics & Engineering;

STRATEGIES AND PROSPECT

In 2025, the Chinese government adhered to the principle of seeking progress while maintaining stability, promoting stability through progress, upholding integrity while innovating, establishing the new before abolishing the old, systematic integration and coordinated cooperation. It aims to implement a more proactive fiscal policy and a moderately loose monetary policy, enrich and improve the policy toolbox, and enhance the forward-looking, targeted and effective nature of macro-control. It will continue to strive for transforming methods, adjusting structures, improving quality and increasing efficacy and persistently consolidate the economic foundation in a positive trend in stability. The expected GDP growth target for 2025 is approximately 5%, the expected increase in consumer prices is approximately 2% and the deficit-to GDP ratio is planned to be arranged at approximately 4%, which is 1 percentage point higher than last year.

In terms of infrastructure construction, more proactive fiscal policy will be implemented in 2025. The government has proposed the plan to issue RMB1.3 trillion of ultra-long-term special government bonds and the plan to arrange RMB4.4 trillion of local government special bonds to provide greater support for “dual-key” construction. Among which, the scope of support for water conservation will be expanded to large and medium sized irrigation areas and large and medium-sized water diversion projects nationwide. Projects such as inter-city railway construction in key metropolitan areas will be included in the scope of support and nationwide action will be comprehensively implemented to effectively reduce logistics costs for society. In addition, in 2025, the project list of approximately RMB100 billion had been issued in advance. The continuously increasing government investments had an effect of leveraging a small effort to achieve a great result of promoting the formation of more tangible workload and fostering investments in infrastructure projects

In terms of real estate, the Chinese government proposed to incorporate the new changes in the supply and demand dynamics of the real estate market and the people’s new expectations for high-quality housing to coordinate research on policies and measures to absorb existing housing inventory and optimize supply of new housing to grasp the construction of new model for real estate development. Since 2024, supportive policies have been continuously reinforced. In May 2024, the People’s Bank of China issued three major housing loan policies, proposed to remove the nationwide lower limits on interest rates for first and second home commercial personal housing loans, lower interest rates for personal housing provident fund loans, and adjust the minimum down payment ratio policy for personal housing loans. The bank also announced the establishment of a RMB300 billion loan for refinancing affordable housing to support local state owned enterprises in acquiring unsold completed commodity housing at reasonable prices to be used as placement-type or rental-type affordable housing. Since then, various regions across China successively announced the removal of the lower limits on interest rates for local first and second home loans and reduction of the minimum down payment ratio. The Central Politburo meeting held in September 2024 clearly proposed to “promote the halt in decline and stabilization of the real estate market”. Multiple ministries accelerated the enhancement of policies such as land, fiscal taxation and finance, coordinated efforts to deliver a policy package, and a series of policies had been successively implemented. Under the influence of these policies, market confidence in the real estate market had been gradually boosted. In the medium to long term, new-type urbanization has not yet been completed. There is still potential for demand for basic housing and housing to improve living conditions, and demand for safer, more comfortable, greener and smarter high-quality housing will still increase. A new model of real estate market development will also be gradually established, which will contribute to the stable and healthy development of the real estate market.

In terms of rural construction, the 2025 Central Document No. 1 proposed that, to achieve Chinese-style modernization, comprehensive revitalization of rural areas must be accelerated and pointed out that more efforts should be made to promote rural construction and facilitate the extension of infrastructure to rural areas. A new round of rural road improvement actions will be implemented, and identification and rectification of risks of rural roads, bridges and tunnels will be launched to continuously promote the high-quality development of “Four Good Rural Roads”. The document required for strengthening the support of investments within the central government budget, ultra-long-term special government bonds and local government special bonds for the construction of major agricultural and rural projects; continued implementation of renovation of dilapidated rural housing and seismic retrofit of rural houses, as well as effective restoration and rebuild of housing collapsed or damaged in disasters in disaster stricken areas, which will be conducive to supporting the demand for building materials such as cement.

Looking ahead, the Group will focus on the annual management theme of “Deepening Reform, Born Anew”, continue to strengthen and enhance the three main businesses of cement, aggregates and concrete, deepen cost reduction across the entire value chain, unleash the advantages of integrated synergy and continuously enhance core competitiveness. The Group will accelerate the pace of upgrading traditional industries, intensify research and development in science and technology, promote the application of intelligent, green and high-end technologies, and develop new quality productivity according to local conditions. The Group will accelerate the layout of strategic emerging industries, continuously optimize resources allocation, provide the public with high-quality products, services and systematic solutions, lead digital and intelligent transformation, achieve a long-term foundation, and build a world-class building materials technology enterprise.

APPRECIATION

I would like to take this opportunity to thank the Directors, the management team and all employees for their contributions and hard work, which had contributed to the high-quality development of the Group’s business. On behalf of the Board, I would also like to express our gratitude to shareholders, customers, suppliers, business partners and other stakeholders for their persistent trust and unfailing support to the Group.

JING Shiqing

Chairman

Hong Kong, 14 March 2025

PRINCIPAL RISKS AND UNCERTAINTIES

Cement and concrete are the main and basic building materials for infrastructure projects, property construction and rural development. Cement consumption is highly correlated to economic development and FAI. As cement and concrete are relatively heavyweight building materials, the key to success of a producer’s business is highly dependent on its core competitive advantage within the regional market. The performance of the Group’s business operation is therefore subject to certain major factors such as the business environment of the regions where the Group has business operation, which significantly affects the selling prices of the cement and concrete products. Besides, coal cost represents one of the significant causes for volatility in the cost of cement production. Accordingly, the substantial fluctuation of coal price poses one of the principal potential risks and uncertainties affecting the performance of the Group and the cement industry at large. As the Chinese government continuously poses stricter requirements for energy saving and carbon emissions reduction, dual control of energy consumption, production safety and occupational health, the Group’s competitiveness in these aspects is the key to its sustainable development.

PRODUCTION CAPACITY

Changes to Production Plants

In terms of clinker and cement, during the year, the clinker and cement production capacities of the Group remained unchanged.

In terms of concrete, during the year, the Group constructed and commenced operation of 1 new concrete batching plant, leased 5 new concrete batching plants and disposed of 1 concrete batching plant. The total annual production capacity of concrete increased by approximately 5.8 million m3 compared to the end of 2023.

Capacity Utilization

The utilization rates of the Group’s cement, concrete and aggregates production lines in 2024 were 69.2%, 33.9% and 85.9% as compared with 71.8%, 25.9% and 93.4% respectively for 2023.

COST MANAGEMENT

In 2024, focusing on the management theme of “strengthening the foundations and grasping upgrades, promoting transformation through technological innovation” and by focusing on enhancing mindsets, capabilities and work styles, the Group united efforts to concentrate on strengthening the operation and management of basic building materials, implemented the strategy of the lowest total costs, continued to solidly execute project construction, and put the concept of “construction as operation” into practice for the full commitment to advancing the implementation of key tasks in the annual business plan and achieving operational targets. The Group strengthened its foundations by developing cost analysis capabilities of the whole value chain to systematically reduce production costs, resulting in significant reduction in the costs of most products compared to the corresponding period last year and the budget. The Group implemented “dual carbon” actions to continuously improve energy consumption levels; vigorously developed the aggregates business, accelerated the construction of aggregates projects, enhanced the management level of aggregates and comprehensively promoted lean management to improve corporate competitiveness.

The Group actively responded to the national strategy of “carbon peaking and carbon neutrality”, promoted the implementation of operation management and control of basic building materials, steadily implemented the “Four-Year Action Plan for Energy Saving and Carbon Reduction” and continued to promote the use of alternative fuels. Standard coal consumption per ton of clinker products had decreased compared to the average in 2023. 18 production lines had reached the first-level energy consumption benchmark stipulated in the requirements of GB16780 “The Norm of Energy Consumption Per Unit Products of the Cement”, representing an increase of 4 lines compared to 2023 and an increase to 42% in the proportion of production capacity.

In 2024, cost reduction management system across the whole value chain was established and refined. Management work across the whole value chain was launched in various aspects including production, procurement, logistics and workforce efficiency, which had consolidated the responsibility for cost management, adopted various measures such as management and control of process supervision and launch of lean management projects to achieve cost reduction targets. We are committed to restoring the advantage of the lowest total costs.

In terms of operational management of mines, through refined cost accounting management in the production process, the Group formulated optimization measures targeting on weaknesses to reduce costs. External procurement of limestone was reduced by establishing regional ore resources allocation mechanism. Revitalization and utilization of idle assets was deepened through measures such as strengthening management and control of equipment maintenance, regular comprehensive inspections and internal deployment, which had raised asset efficacy.

In terms of project construction management, the Group strictly implemented the oversight mechanism for regular project management. The headquarters held monthly project promotion meetings in which the Company’s senior management participated for supervision. The Group launched supervision and inspection on prominent issues and concentrated the headquarters’ efforts to expedite resolution. The Group also coordinated the deployment of project management personnel to station at project sites to promote broad and in-depth project management at the headquarters level, coordinated the launch of thorough review on licenses and risk assessment for each project, and accelerated the processing of licenses. The targets for commencement of production of projects had been included in the annual performance contracts of production plants to fully motivate the subjective initiative of the production plants and effectively accelerate the project process. The Group regularly organized and launched project management alert meetings and training for whole-process management of project construction to strengthen the risk awareness of project personnel at all levels and enhance the capabilities of project management personnel. The Group organized and launched special self examination and self-correction in the field of infrastructure projects to deepen and solidify compliance management of engineering projects. Special inspections on safety management were carried out regularly for all projects under construction and aggregates production lines which had commenced operation in recent years to ensure that no construction or production would be launched under unsafe conditions.

In terms of aggregates business management, the Group adheres to the concept of “construction as operation” and strictly enforces safety, quality, progress and cost management and control, places great emphasis on contract performance and cost management and control throughout the construction process, and focuses on critical stages such as project construction and project trial operation by commencing production ahead of competitors to capture the markets and boost performance. In terms of production and operation, the Group had preliminarily established an aggregates operation and management system, diligently implemented whole-process lean management, conducted internal and external benchmarking and competitiveness analysis of production plant to improve quality and reduce costs.

In addition, the Group continued to strengthen cost reduction and efficiency enhancement of the engineered stone business. In 2024, the Group managed to save production costs and expenses through measures such as centralization of procurement channels, substitution of raw materials, optimization of prescriptions and process adjustments.

Procurement Management

In 2024, the domestic demand for coal was insufficient and the volume of imported coal had reached record high again, leading to general looseness in market supply. During the year, the Group purchased a total of approximately 6.3 million tons of coal (approximately 6.6 million tons in 2023), among which, approximately 68%, 9% and 23% were sourced from northern China, neighbouring areas of our production plants and overseas respectively (82%, 10% and 8% in 2023). The proportion of direct procurement from coal producers was approximately 81% (88% in 2023).

In the future, the Group will continuously maintain the strategic cooperation with large-scale domestic coal suppliers, maintain a relatively high fulfilment rate of long-term contracts, and strive for delivery of Australian coal to South China shores to replace domestic spot coal. At the same time, the Group will consolidate strategic cooperation for Australian coal and increase the proportion of imported coal procurement. The Group will enhance channel development efficiency, continue to expand direct procurement channels and increase the proportion of direct supply from the source. Comparative analysis of market prices in southern and northern ports will be conducted weekly, and low-priced and high-calorie imported spot coal will be purchased flexibly.

In terms of mineral admixtures, first, the Group expanded procurement channels, enhanced the frequency and quality of market research and introduced cost-effective channels. Second, the Group developed direct procurement from the source, built up coordination mechanism for cross-organizational communications and introduced new sources for direct procurement. Third, the Group strengthened regional centralized procurement, sorted out the common needs within and across regions and formulated measures for improving the effectiveness and efficiency of centralized procurement. Fourth, the Group negotiated price adjustments for cost reduction, grasped the market conditions of various mineral admixtures and conducted price negotiations in a timely manner.

Aggregates are the main raw materials for concrete production. The Group coordinated the expansion of internal aggregates collaboration to unleash the advantages of integrated holistic efficacy, and conducted procurement business benchmarking to effect dynamic price management. At the same time, the Group enhanced the depth and breadth of market research, continued to promote exploration of direct procurement from the source and supplier development in each region, fully utilized resources in the vicinity of our production plants, developed alternative materials, and conducted joint production experiments to optimize mix proportions. In addition, according to fluctuations in market supply and demand, the Group optimized procurement strategies and flexibly introduced channels through a set of strategies to foster competition.

Logistics Management

In 2024, the Group adopted a series of measures to achieve an overall downward trend in logistics cost. In terms of shipping, the Group reduced shipping costs in multiple steps through methods such as organizing and optimizing shipping routes, adjusting ship types, continuously exploring lower shipping freight rates and leading a downward trend in market freight rates during dry season, adjusting shipping points based on the principle of the lowest total costs, continuously improving the compatibility of ship types and reducing the demurrage of sea ships. In terms of truck transportation, the Group continued to compress logistics costs through measures such as planning two-way logistics, leveraging on the advantages of economies of scale and exploring new energy vehicle business.

In 2024, the annual shipping capacity of the Group along the Xijiang River was approximately 45.3 million tons, which secured stable and continuous logistics capabilities for business operations. The Group continuously optimized the layout of its silo terminals and occupied high-quality silo terminal resources. During the year, the Group controlled the operation of 30 silo terminals with total annual capacity of approximately 31.0 million tons, which are mainly located in the Pearl River Delta Region of Guangdong. This consolidates the Group’s leading market position in Southern China.

SALES AND MARKETING

Product Promotion

In 2024, the Group continued to strengthen the promotion of specialized products such as cement for nuclear power stations and Portland cement for roads to deepen our differentiated competitive advantages. In addition to continuing to supply cement for nuclear power stations to multiple nuclear power projects in Zhejiang, Fujian, Guangdong and Hainan, the Group had also further increased the supply of pre-stressed cement to meet the special needs of nuclear island domes. At the same time, relying on the advantages of provincial units and academia enterprise cooperation, the Group actively promoted Portland cement for roads. During the year, on the basis of the smooth advancement of the “Strong Transportation Nation” project jointly launched with Fuzhou University, China, the Group assisted the Highway Administration Bureau Business Development Centre of Fujian Province in formulating the “Technical Guidelines for Wear Resistant, Low Shrinkage and Crack-Resistant Pavement Cement”, and jointly hosted the “Technical Review and Promotion Meeting for Wear-Resistant and Low Shrinkage Pavement Cement” with the Highway Administration Bureau Business Development Centre of Fujian Province and Fuzhou University, China, which determined the technical indicators for wear-resistant and low-shrinkage pavement cement and promoted the continuous inclusion of the “Runfeng Brand” Portland cement for roads in the list of key recommended cement and brand for highway construction in Fujian. In 2024, the “Runfeng Brand” Portland cement for roads had been successively applied in key airport construction projects such as Phase 2 of the Fuzhou Airport project and the pavement construction project of the new Xiamen Xiangan Airport.

In addition, the Group full leveraged on its collaborative advantages in resources by continuously applying specialized products such as medium-heat and low-heat cement in large-scale national infrastructure projects in Southwest China such as multiple key control engineering projects in the Sichuan and Tibet sections of the Sichuan-Tibet Railway and six highland hydropower station projects in the Sichuan-Tibet region.

Brand Building

In 2024, the Group was committed to comprehensively enhancing the terminal influence of the “Runfeng” brand and strengthening the creation of the “Runpin” brand. In 2024, the Group was committed to comprehensively enhancing the terminal influence of the “Runfeng” brand in its basic building materials and structural building materials businesses and focusing on the construction of brand terminal penetration. During the year, the “Runfeng Aggregates” brand image building was completed for 33 operating aggregates production plants, which had basically achieved full coverage of the brand image in scenarios of aggregates sales. The “Special Improvement Plan for Key Users and Renovation Companies” was launched to continuously enhance reputation of products and brand, which had achieved a brand terminal coverage rate of 95.4% throughout the year and new cooperation with 1,736 key users and 118 renovation companies. In 2024, customer satisfaction rate was 98.2% and had been no less than 98% for two consecutive years.

In 2024, upon the basis of promoting joint venture brand replacement and integration of “Runpin” of the functional building materials business and relying on professional exhibitions and large-scale activities such as the China Xiamen International Stone Fair, China Concrete Exhibition and the “Runpin” Interior Design Forum, the Group showcased the “Runpin” brand image and its ecosystem of building materials products to customers. The Group had built “Runpin” flagship stores, showrooms and terminal stores, and regularly held activities such as “Master Lectures” to continuously shape the brand image.

In addition, the Group also relied on corporate strength to further expand the influence of the dual brands of “Runfeng” and “Runpin”. The “China Resources Building Materials Technology Product Manual” was released, and the product and service strengths of the two major brands of “Runfeng” and “Runpin” were systematically promoted to customer clusters. On 28 June 2024, the Group successfully held the 2024 brand anniversary celebration cum partner conference to mobilize customers for boosting confidence and create a situation for symbiotic, mutually beneficial and win-win cooperation.

TRANSFORMATION AND INNOVATION

New Business Development

In 2024, the Group actively promoted the development of new businesses, fully utilized the integrated collaborative advantages between cement, aggregates and concrete, accelerated the construction and operation of aggregates projects, and continued to optimize business structure, with continuous increases in the proportions of assets and revenue of new businesses.

Aggregates

In 2024, the Group accelerated the construction and commissioning of its existing aggregates projects. In February 2024, the Group officially completed construction and commenced operation of Runsheng Quarry, with new annual production capacity of approximately 2.0 million tons of aggregates in Zhaoqing City, Guangdong. In March 2024, the Group officially completed construction and commenced operation of the concrete project with supporting aggregates production line, with new annual production capacity of approximately 2.0 million tons of aggregates in Pingnan County, Guigang City, Guangxi. In July 2024, the Group officially completed construction and commenced operation of the Dongye Mountain aggregates project, with new annual production capacity of approximately 5.0 million tons of aggregates in Qintang District, Guigang City, Guangxi. In October 2024, the Group officially completed construction and commenced operation of the Wuzi Mountain aggregates project, with new annual production capacity of approximately 2.0 million tons in Fuchuan County, Hezhou City, Guangxi. In the same month, the Group commenced trial production of the aggregates project, with new annual production capacity of approximately 3.0 million tons in Weishan County, Dali Bai Autonomous Prefecture, Yunnan. In December 2024, the Group commenced trial production of the Runyang aggregates project, with new annual production capacity of approximately 5.0 million tons in Chongyang County, Xianning City, Hubei.

As of 31 December 2024, based on its own existing cement mines, the Group’s annual production capacity of aggregates in operation through its subsidiaries (inclusive of trial production) was approximately 108.6 million tons, and the total annual production capacities of aggregates attributable to the Group according to our equity interests of the associates located in Yunnan and Fujian were approximately 3.7 million tons. Upon completion of construction of all projects, the annual production capacity of aggregates controlled by the Group through its subsidiaries is expected to reach 134.8 million tons and the annual production capacity of aggregates attributable to the Group according to our equity interests of associates and joint ventures will reach approximately 13.6 million tons.

Functional Building Materials

In 2024, the Group had preliminarily completed the nationwide layout of its engineered stone business. The Phase 1 expansion of the second production line for inorganic engineered stone of DongGuan Universal Classical Material Ltd. in Dongguan, Guangdong had commenced operation with planned annual production capacity of approximately 1.5 million m2. The intelligent inorganic engineered stone production line project in Laibin, Guangxi of Laibin Universal Classical Material Ltd. is under construction in two phases with total planned production capacities of 6.0 million m2. The first phase of the two production lines with planned annual production capacities of 3.0 million m2 had officially commenced operation in December 2023. Currently, the Group’s annual production capacity of engineered stone is approximately 26.1 million m2.

The Group continued to strengthen cost reduction and efficiency enhancement of the engineered stone business. In 2024, the Group managed to save production costs and expenses through measures such as centralization of procurement channels, substitution of raw materials, optimization of prescriptions and process adjustments.

Digital Transformation

As a benchmark enterprise of China Resources Group in digitalization and intelligentization, the Company continued to promote the construction of digitalization and intelligentization, was committed to promoting the transformation and upgrade of traditional industries, and used advanced technology to help improve corporate management and operational efficiency.

In terms of intelligent factories, the Group summarized and promoted the experiences of advanced manufacturing of the “Lighthouse Factory”, formed a set of lighthouse mechanisms to promote the creation of lighthouse network and the cement production plant at Tianyang of Guangxi received the accreditation of science general education production plant in Baise City. The Group independently promoted the artificial intelligence vision based “intelligent control technology of alternative fuels” in the cement production plants at Hepu, Nanning and Midu to stabilize the feed rate of alternative fuels, reduce air leakage, lower the standard deviation of decomposition furnace temperature, further reduce costs and improve efficiency.

The Group continued to deepen intelligent digital empowerment and promote application of mature intelligentization. Production safety management system had been launched in 15 production plants including Nanning, Luoding and Wuxuan, which expedited the standardization of production safety and the construction of dual prevention mechanisms. The independently developed whole-process advanced control system had been launched in production plants at Midu and Caoxi. The quality management system had been launched in 5 production plants at Zhanjiang, Shantou, Dongguan, Jinjiang and Changjiang. The equipment online monitoring system had been launched in the aggregates production plants at Wuxuan and Shangsi. The energy management system had been launched in the production plants at Anshun and Jinjiang.

As a deputy director unit of the China Building Materials Federation, the Group participated in the formulation of industry standards and completed the release of two group standards, namely, the “5G Smart Safety Helmet for the Cement Industry” and the “Technical Requirements for 5G Virtual Private Network for the Cement Industry”, as well as the “5G RedCap Technology and Practice White Paper”. The Group was approved as the “Building Materials Industry (Cement) Standardized Workstation for Quality Traceability”, one of the three standardization workstations in the first batch in the building materials industry, and was awarded a plaque by the China Building Materials Federation.

Research, Development and Innovation

Innovation is an important momentum to stimulate corporate vitality and motivate long-term corporate development. As of 31 December 2024, the Group had 552 technology talents, among whom, there were 3 China Resources Group-level scientific and technological leading talents, 5 company-level scientific and technological leading talents, 7 company-level scientific and technological backbone talents. Over 150 employees were specialized in research and development, among whom, there were 7 professor-level senior engineers, 14 employees with doctorate degrees, and 48 employees with master's degrees.

In 2024, the Group actively promoted research and development of new products and new technologies. The Group completed the development and engineering application of technical equipment for rotary furnace at the cement production plant in Hepu of Guangxi, which had met performance assessment requirements. The application of energy-saving and carbon reduction technologies in roller presses of raw materials and cement grinding had been promoted. At the same time, the Group keeps pace with the new era in dual-carbon, lead the promotion of green and innovative development by independently developing raw materials additives, which had been tested at the production plants of Hongshuihe, Pingnan and Guigang. The Group had developed re-engineering technology for carbon dioxide in-situ self-enrichment process with the Company’s characteristics, as well as high-solidity carbon free autoclaved aerated concrete products, and built a research platform for carbon utilization at the cement production plant in Fengkai of Guangdong to achieve the integrated industrial process of carbon capture and carbon utilization for creating a carbon neutral pilot line for the cement industry. The pilot project initially possesses carbon dioxide capture capacity of 100,000 tons per year. In terms of new building materials, the independently developed cement carbon reduction and grinding aid technology has been applied at 10 new production plants, which can reduce the cement clinker coefficient by 4%–6%. This technology had passed the scientific and technological accreditation of the China Building Materials Association and had been recognized as having generally reached an international leading standard. In addition, the Group continuously promoted the implementation of projects such as high-quality aggregates, comprehensive utilization technology of aggregates solid waste, low-carbon and high-performance concrete, low-resin engineered stone and high-quality granite waste slurry, which fostered high-quality corporate development.

In 2024, the Group executed the following four measures to create an innovation paradigm that coordinated efforts between training of scientific and technological talents, industry-academic-research collaboration, intellectual property management and construction of innovation culture. First, the Group continued to promote training of scientific and technological talents. The first phase of the “2024 Outstanding Engineers Practical Advancement Project” was launched to train a total of 64 outstanding engineers. Second, the Group strengthened external cooperation and increased output of scientific and technological achievements. The project of “Research and Application Demonstration of Key Technologies for the Precise and Harmless Disposal and Total Resource Utilization of Electrolytic Manganese Slag” under the Guangxi Science and Technology Scheme jointly applied with the Guilin University of Technology, the project of “Key Technologies in Engineering Projects for Treating Major Geological Disasters in Underground Coastal Karst Areas” under the Guangxi Science and Technology Scheme jointly applied with Shandong University, the project of “Key Technologies and Industrial Demonstration for Co-Processing by Use of Cement Kilns and Coordinated Carbon Reduction of Waste Cathode Carbon Blocks” under the Guangxi Science and Technology Scheme jointly applied with the South China University of Technology and the Guilin University of Technology and the project of “Research and Application of Online Status Monitoring and Fault Diagnosis of Key Equipment in the Cement Production Transmission Chain” under the Yunnan Provincial Special Project for Higher Education Serving Industry Science and Technology jointly applied with the Yunnan University had been approved in 2024. The Group was honoured with 6 provincial and ministerial awards, among which, the “Key Technologies in Engineering Projects for Treating Major Sudden Water Disasters in Underground Coastal Karst Areas” was awarded the first prize of the Science and Technology Progress Award of the Chinese Society for Rock Mechanics & Engineering, the “Key Technologies and Equipment Research, Development and Application of Trolley-type Ultra-Energy-Saving Belt Conveyor Systems” was awarded the first prize of the Science and Technology Progress Award of the China Nonferrous Metals Industry Association, and the “Research, Development and Application of Sensible Heat Recovery Technology and Equipment for Waste Gas in Coke Oven Ascension Pipes” was awarded the second prize of the Science and Technology Progress Award in Anhui Province. Third, the Group attached importance to intellectual property protection. As of 31 December 2024, the Company held a total of 372 valid patents, including 91 invention patents, 279 utility model patents and 2 exterior design patents, 49 new authorized patents were added and the number of new article submissions was 47. Fourth, the Group constructed innovative culture.

EMPLOYEES

General Information

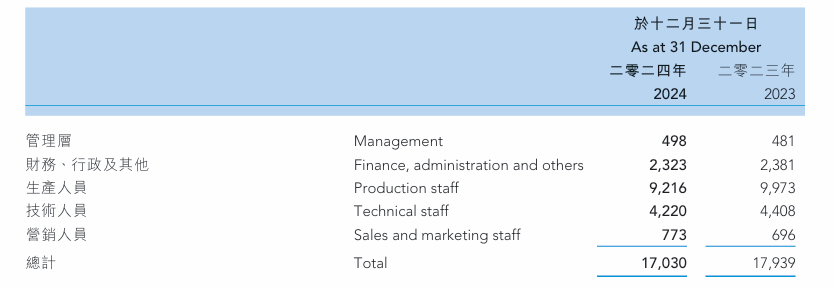

As at 31 December 2024, the Group employed a total of 17,030 employees, all of whom were full-time, among whom, 385 were based in Hong Kong and the remaining 16,645 were based in the Chinese Mainland (17,939, 343, 17,596 respectively as at 31 December 2023). A breakdown of our employees by function is set out as follows:

Among our 498 senior and middle-level managerial staff, 86% are male and 14% are female, 85% possess university degrees or above, 14% have received post-secondary education and the average age of managerial staff is approximately 47 (481, 86%, 14%, 84%, 14%, 47 respectively as at 31 December 2023).

The Group has established a remuneration allocation mechanism based on job value and combined with performance contribution, personal ability and talent development, paid in form of cash bonuses. The total staff costs (including Directors’ emoluments) of the Group was approximately RMB2,829,743,000 during the year (RMB3,056,899,000 in 2023).

Based on the talent training plan during the Fourteenth Five-Year period, the Group focused on the “3+1” talent team cultivation, carried out special talent training step by step, designed and launched training programmes, and provided career guidance and follow-up training for young employees.